Till Death Do Us Part: How Couples Can Create Retirement Income for Life

Clayton Brown

.7 Oct 2021

.6 Min Read

As we approach retirement, we start to spend more time thinking about our mortality, especially when we expect our future is likely shorter than our past. Of the many thoughts this brings up, how our partner/spouse will be cared for financially after we’re gone is a significant consideration. In preparation for retirement and planning the estate we will leave behind, there are various options and decisions to consider. Let’s explore a few common pieces of the retirement puzzle from this perspective, namely registered accounts, the Canadian Pension Plan (CPP) and Old Age Security (OAS), as well as some other income solutions.

Registered Accounts

These accounts, which include your RRSP/RRIF, LIRA/LIF and TFSA, allow you to either name a direct beneficiary or a successor holder/annuitant. In simple terms, if you name your spouse as a beneficiary, your account balance can roll over to them without any adverse tax consequences when you pass away. This is highly beneficial, as taxes form a significant part of the retirement (or decumulation) puzzle that so many Canadians are looking to solve.

Lifetime Income Solutions

There are several products that may come to mind here. A defined benefit (DB) pension plan may offer some survivorship benefits – often between 60% and 100% – that can be selected at the time the pension benefit starts. The higher the survivor benefit chosen, the lower the starting lifetime income payments will be. Unfortunately, most Canadians today don’t have the luxury of access to this kind of pension.

Annuities

Annuities sometimes offer guarantees and survivorship benefits. But like DB pension plans, the more finances you secure for your surviving spouse, the lower your income payments will be. And there’s little flexibility offered: typically, once you buy an annuity, you can’t change the terms of the contract. This means you can’t switch to a different type of annuity or get your money back. Their high probability of guaranteed income is balanced by their lack of flexibility.

The Canadian Pension Plan and Old Age Security

The CPP is a well-managed pool of money that is expected to be sustainable for at least the next 75 years¹ – a very secure income source for Canadians. Under the most common scenario for those over age 65, the surviving spouse will receive 60% of the contributor's retirement pension, up to the maximum CPP benefit for an individual of around $1,200 per month.²

On the other hand, OAS, which is paid for from the government tax base and therefore highly secure, provides no survivorship benefit – when you go, so does your OAS.

The Longevity Pension Fund

Longevity was designed in a way that provides a higher starting income payment than other lifetime income solutions, with payments that cannot be passed to a spouse or partner. What that means is that when you die, the units you held are automatically redeemed for any remaining value and could then go to your surviving spouse. Remember that the redemption value is the lower of either the initial investment less the total distributions received, or net asset value of the investment. This means your investment in Longevity has a declining redemption value that will eventually get to $0 after about 12-16 years. Couples need to consider this fund thoughtfully when planning for their future together.

Common Usage Scenarios of Longevity

Because Longevity is a unique investment solution, investments might be structured differently for couples that are interested in investing to suit their specific needs. Investors should always consult with an investment advisor before investing.

For instance, many couples may want to balance their retirement needs between both receiving income to enjoy their retirement, while also leaving something behind for their estate. Longevity doesn’t pay income to an investor’s estate, but it provides an opportunity to meet income needs, particularly if investors split their investment in the Longevity Pension Fund evenly between them. This way, when one of them passes away, the income the other continues to receive will reduce by half (assuming they’re around the same age). By keeping a portion of their assets in other investments, which should not be affected by the passing of the first spouse, the surviving spouse could expect to see overall income drop by a similar proportion to his or her monthly costs.

There are other considerations to take into account when assessing income vs estate needs when planning for retirement. Often, one spouse manages or better understands the family finances, while their partner might be less involved and have a more limited understanding. In this situation, the one who is guiding the financial decisions may want to secure more recurring income for their spouse to simplify the financial decision-making if they were to pass away first.

The same logic could apply to couples that have a large age gap, where one person expects to outlive the other by several years or potentially several decades. They may find it more appropriate to skew an investment split towards the younger spouse.

Finally, couples may have a specific retirement expense that will disappear when one of them passes away. Tying that expense to an income solution, rather than withdrawing capital (selling investments), may be more advantageous. Some examples of this include a vacation property, a boat or other toy, or a club membership that the surviving spouse may not wish to continue funding.

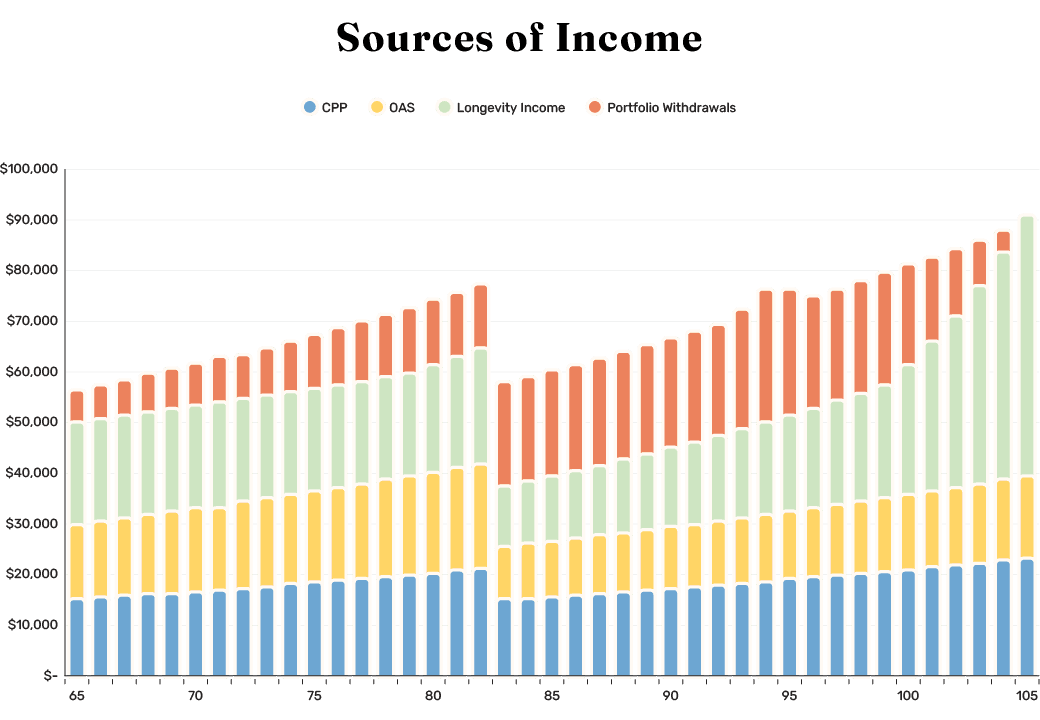

Longevity Hypothetical Spouse Case Study

As an example, let’s consider a hypothetical couple (we’ll call them Fred and Wilma). Fred and Wilma are a recently retired couple (both 65-years-old) with two children. Each of them has $330,000 in their RRSPs. After meeting with their investment advisor, they realize that the retirement lifestyle they are planning for will require some ongoing income. One of the options their investment advisor presents as a part of their portfolio is the Longevity Pension Fund. With their advisor’s help, Fred and Wilma decide to invest 50% of their respective RRSPs into the Longevity Pension Fund.

In this example, both Fred and Wilma qualify for full OAS and each receive the average monthly CPP benefit ($619.442). Their goal is to generate $55,000 per year in pre-tax income. We will assume they earn 3.75% after-fee returns on their balanced portfolio, and that inflation is 2% per year.

Unfortunately, Fred passes away at age 82. What does this mean for Wilma financially?

In planning for this potential income, Fred & Wilma expected that Wilma’s ongoing expenses will be 75% of what they were prior to him passing, so her pre-tax income goal drops down to $41,250 per year. In this scenario, Fred’s OAS will disappear, Wilma’s CPP will be boosted by the CPP survivor’s pension, and she will be able to use her remaining assets to sustain her income goal for the rest of her life.

Looking Forward

In summary, the retirement puzzle is complex and requires careful consideration. Many aspects or decisions can have a domino effect on other areas, and those may not always be obvious. As Benjamin Franklin famously quipped, “in this world, nothing is certain except death and taxes.”

We can all agree that we should do our best to leave our loved ones with the peace of mind they deserve. We encourage you to contact your trusted advisor(s) to ensure that your financial intentions and realities are aligned.

Keep in mind that you should always speak with a registered investment advisor about investments and whether they might be suitable for you (note that the Longevity Pension Fund does not offer investment advice and does not employ investment advisors). If you are looking to speak a Certified Financial Planner® about your current or future retirement plans, you can reach out to Longevity’s Retirement Income Planner here.

1. “Sustainability of the CPP,” CPP Investments: https://www.cppinvestments.com/the-fund/our-performance/sustainability-of-the-cpp

2. “CPP retirement pension: How much you could receive,” Government of Canada: https://www.canada.ca/en/services/benefits/publicpensions/cpp/cpp-benefit/amount.html

Disclaimer

Always review the prospectus and speak to your advisor before investing. Commissions, trailing commissions, management fees and expenses all may be associated with the Fund. Investments in the fund are never guaranteed, and the Fund’s value may change frequently. Past performance may not be repeated. Distribution levels and frequency may increase or decrease from time to time.

Not Investment Advice

The content of this document is for informational purposes only, and is not being provided in the context of an offering of any securities described herein, nor is it a recommendation or solicitation to buy, hold or sell any security. The information is not investment advice, nor is it tailored to the needs or circumstances of any investor. Information contained on this document is not, and under no circumstances is it to be construed as, an offering memorandum, prospectus, advertisement or public offering of securities.

Forward-Looking Statements

Forward-looking statements (“FLS”) are statements that are predictive in nature, depend on or refer to future events or conditions, or that include words such as “may,” “will,” “should,” “could,” “expect,” “anticipate,” intend,” “plan,” “believe,” “estimate” or other similar expressions. Statements that look forward in time or include anything other than historical information are subject to risks and uncertainties, and actual results, actions or events could differ materially from those set forth in the FLS. FLS are not guarantees of future performance and are by their nature based on numerous assumptions. Although the FLS contained in this document are based upon what Purpose Investments believes to be reasonable assumptions, Purpose Investments cannot assure that actual results will be consistent with these FLS. The reader is cautioned to consider the FLS carefully and not to place undue reliance on the FLS. Unless required by applicable law, it is not undertaken, and specifically disclaimed, that there is any intention or obligation to update or revise FLS, whether as a result of new information, future events or otherwise.